SpaceX, officially known as Space Exploration Technologies Corp., has emerged as a formidable player in the aerospace industry since its inception in 2002. Founded by Elon Musk, the company has revolutionized space travel and exploration with its ambitious goals, including reducing the cost of space access and enabling human life on other planets. Unlike traditional aerospace companies, SpaceX has adopted a unique approach that combines innovative technology with a focus on reusability, which has significantly altered the landscape of space exploration.

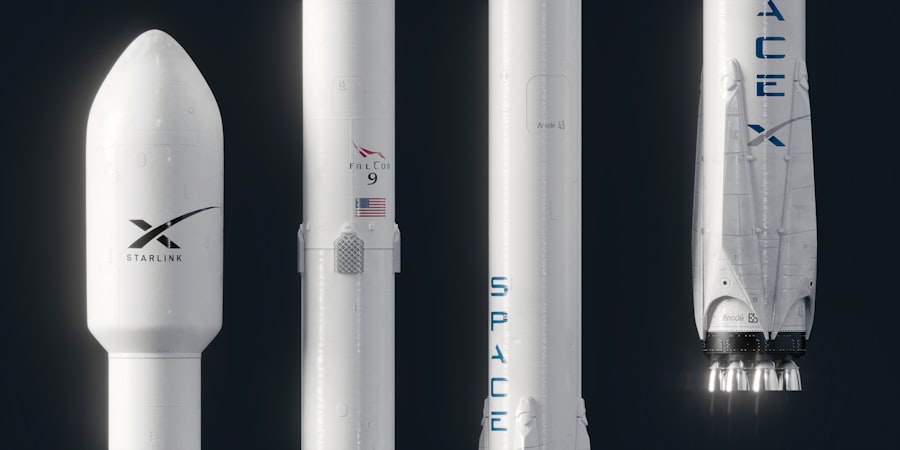

As a private company, SpaceX has not yet gone public, but its stock is highly anticipated among investors, particularly as the company continues to achieve remarkable milestones. The allure of SpaceX stock lies not only in its groundbreaking achievements but also in the potential for substantial returns. The company has garnered attention for its successful launches, including the Falcon 9 and Falcon Heavy rockets, and its ambitious plans for the Starship spacecraft, which aims to facilitate missions to Mars.

As the demand for satellite deployment and space tourism grows, many investors are keen to understand the dynamics of SpaceX’s growth potential and financial performance. This article delves into various aspects of SpaceX stock, including its growth potential, financial performance, comparisons with other aerospace companies, risks associated with investing, future projects, and expert opinions.

Key Takeaways

- SpaceX stock has gained significant attention due to the company’s ambitious projects and potential for growth in the aerospace industry.

- The analysis of SpaceX’s growth potential highlights the company’s innovative technology, successful launches, and contracts with NASA and other organizations.

- Evaluation of SpaceX’s financial performance reveals a strong revenue growth and profitability, despite high research and development expenses.

- When compared to other aerospace companies, SpaceX stands out for its focus on reusable rocket technology and aggressive expansion plans.

- Potential risks and challenges of investing in SpaceX stock include regulatory hurdles, competition, and the unpredictable nature of space exploration.

Analysis of SpaceX’s Growth Potential

SpaceX’s growth potential is underpinned by several key factors that position it favorably within the aerospace sector. One of the most significant drivers of growth is the increasing demand for satellite launches. With the proliferation of satellite technology for communication, weather forecasting, and global positioning systems, the market for satellite launches is expanding rapidly.

SpaceX has established itself as a leader in this domain, offering competitive pricing and reliable launch services. The company’s reusable rocket technology allows it to significantly reduce costs per launch, making it an attractive option for commercial satellite operators. Moreover, SpaceX’s ambitious plans for interplanetary travel and colonization of Mars present a unique growth avenue.

The Starship spacecraft is designed to carry humans and cargo to destinations beyond Earth, including the Moon and Mars. This vision aligns with global interests in space exploration and could open up new markets for space tourism and extraterrestrial resource utilization. As governments and private entities invest in space exploration initiatives, SpaceX stands to benefit from partnerships and contracts that could further enhance its growth trajectory.

Evaluation of SpaceX’s Financial Performance

While SpaceX remains a private entity and does not publicly disclose its financial statements in the same manner as publicly traded companies, various reports and estimates provide insight into its financial performance. The company has successfully secured substantial funding through multiple rounds of investment, raising billions of dollars from venture capital firms and private investors. As of 2023, estimates suggest that SpaceX’s valuation has soared to over $137 billion, making it one of the most valuable private companies globally.

Revenue generation for SpaceX primarily comes from launch services, government contracts, and satellite deployment. The company has established lucrative contracts with NASA for cargo resupply missions to the International Space Station (ISS) and crewed missions under the Commercial Crew Program. Additionally, SpaceX’s Starlink project aims to provide global internet coverage through a constellation of satellites, which could become a significant revenue stream as more users subscribe to the service.

The combination of these revenue sources positions SpaceX favorably in terms of financial sustainability and growth potential.

Comparison of SpaceX with Other Aerospace Companies

| Metrics | SpaceX | Boeing | Lockheed Martin |

|---|---|---|---|

| Founded | 2002 | 1916 | 1995 |

| CEO | Elon Musk | David L. Calhoun | James D. Taiclet |

| Number of Employees | 8,000+ | 140,000+ | 110,000+ |

| Annual Revenue | 2+ billion | 58+ billion | 65+ billion |

| Notable Projects | Falcon 9, Dragon, Starship | Boeing 737, 747, 787 | F-35 Lightning II, Orion spacecraft |

When comparing SpaceX to other aerospace companies such as Boeing and Lockheed Martin, several distinctions become apparent. Traditional aerospace firms have long dominated the industry with established practices and extensive experience in manufacturing and launching spacecraft. However, SpaceX’s innovative approach has disrupted these norms by prioritizing rapid development cycles and cost-effective solutions.

For instance, while Boeing’s Space Launch System (SLS) has faced delays and budget overruns, SpaceX has consistently delivered successful launches on time and within budget. Furthermore, SpaceX’s focus on reusability sets it apart from competitors. The Falcon 9 rocket’s first stage can be reused multiple times, significantly lowering launch costs compared to expendable rockets used by other companies.

This reusability not only enhances profitability but also aligns with environmental sustainability goals by reducing waste associated with single-use rockets. As a result, SpaceX has captured a significant share of the commercial launch market, often undercutting competitors on price while maintaining reliability.

Risks and Challenges of Investing in SpaceX Stock

Investing in SpaceX stock is not without its risks and challenges. One primary concern is the inherent volatility associated with the aerospace industry. Launch failures can occur due to technical malfunctions or unforeseen circumstances, leading to financial losses and reputational damage.

While SpaceX has an impressive track record of successful launches, the potential for setbacks remains a critical consideration for investors. Additionally, regulatory hurdles pose another challenge for SpaceX’s growth trajectory. The company must navigate complex regulations related to space travel, satellite deployment, and environmental impact assessments.

Delays in obtaining necessary approvals or changes in government policy could hinder project timelines and affect revenue generation. Furthermore, as competition intensifies within the aerospace sector, maintaining a competitive edge will require continuous innovation and investment in research and development.

SpaceX’s Future Projects and Their Impact on Stock Performance

Looking ahead, SpaceX has an array of ambitious projects that could significantly influence its stock performance once it goes public. The Starship program is at the forefront of these initiatives, with plans for missions to Mars and beyond. Successful test flights and eventual crewed missions could bolster investor confidence and attract interest from institutional investors seeking exposure to the burgeoning space exploration market.

In addition to interplanetary travel, the Starlink project is poised to reshape global internet access. By deploying thousands of satellites in low Earth orbit, SpaceX aims to provide high-speed internet connectivity to underserved regions worldwide. As more users subscribe to Starlink services, this could translate into substantial revenue growth for the company.

The success of these projects will be closely monitored by investors as they assess the long-term viability and profitability of SpaceX.

Expert Opinions on Investing in SpaceX Stock

Expert opinions on investing in SpaceX stock vary widely among analysts and industry insiders. Some view it as a high-risk but potentially high-reward investment due to its innovative technology and ambitious goals. Analysts who are bullish on SpaceX often highlight its leadership position in the commercial launch market and its ability to secure lucrative government contracts as key indicators of future success.

Conversely, some experts caution against investing in SpaceX due to its status as a private company with limited financial transparency. The lack of publicly available financial data makes it challenging for investors to conduct thorough due diligence. Additionally, concerns about competition from established aerospace firms and emerging startups may temper enthusiasm among more conservative investors who prioritize stability over potential high returns.

Conclusion and Recommendations for Potential Investors

As interest in space exploration continues to grow alongside technological advancements, investing in SpaceX stock presents both opportunities and challenges. While the company’s innovative approach and ambitious projects position it favorably within the aerospace sector, potential investors must carefully consider the associated risks. Conducting thorough research into SpaceX’s financial performance, growth potential, and competitive landscape is essential before making investment decisions.

For those willing to embrace the inherent volatility of the aerospace industry, investing in SpaceX could yield significant returns as the company continues to push boundaries in space exploration. However, it is crucial for investors to remain informed about regulatory developments, market trends, and technological advancements that may impact SpaceX’s trajectory in the coming years. Ultimately, a balanced approach that weighs both potential rewards against risks will be vital for anyone considering an investment in this groundbreaking company.